2021-11-30

Bitcoin is becoming more widely distributed. This is shown by on-chain data.

Quo vadis, crypto market? If Bitcoin and Co. gave a sign of life for the first time in quite some time yesterday, Monday, November 29, today's weather report is rather changeable, in keeping with the time of year. Admittedly, many a coin, including Ethereum (ETH), is trading in the plus. But it is not yet the big liberation blow.

Bitcoin, for example, yesterday still with around 4 percent growth, is today slightly in the red. Up to the editorial deadline, 1.6 percent are on the books on the day.

Within the top 10, the picture is mixed. The biggest gain is made by Dogecoin (DOGE) with 5 percent, which is now also ahead of Shiba Inu (SHIB) with 2 billion U.S. dollars market capitalization.

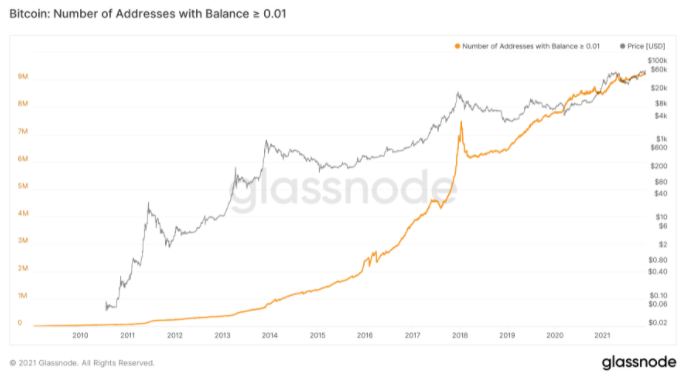

At the same time, the current corrective movements are rather a marginal note in a thoroughly healthy market. One feature of this is, for example, the distribution of Bitcoins between the market participants:inside. In the past, the cryptocurrency was considered to be extremely unevenly distributed (a small number of investors held large parts of the supply), but today this characterization is hardly tenable.

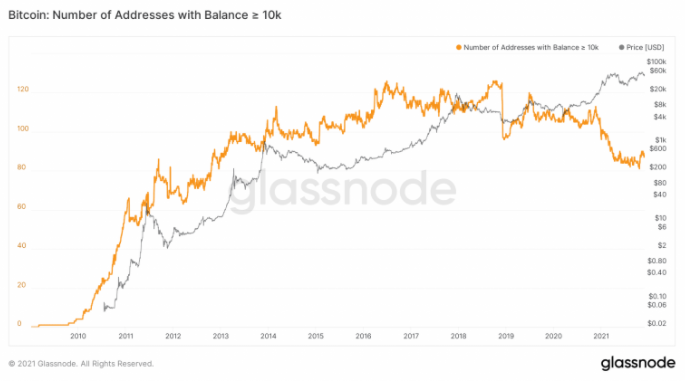

For example, the number of BTC addresses holding at least 10,000 BTC has been steadily declining since the peak in September 2018.

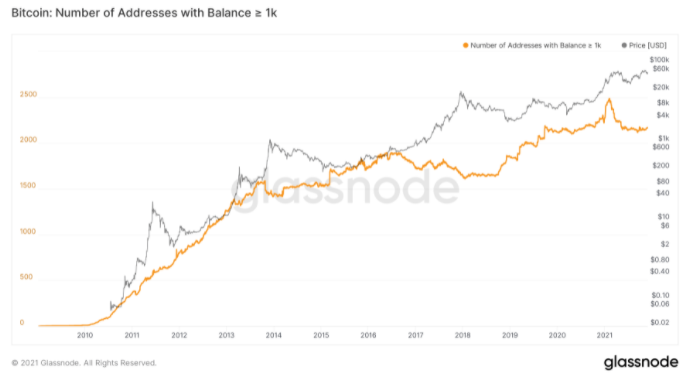

The number of addresses with 1,000 or more Bitcoin has also been declining since February this year.

In other words, there are fewer and fewer whales cavorting in Bitcoin land.

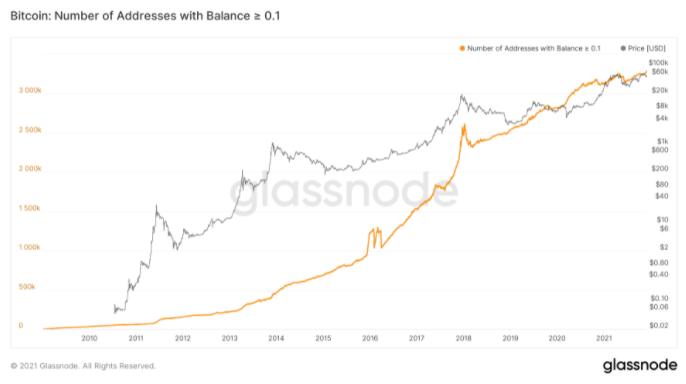

But the coins must have landed somewhere. And indeed, the number of addresses with 0.1 BTC to 1 BTC is steadily increasing.

For the Bitcoin market structure, this is good news. Because a wider distribution of Bitcoin supply means, conversely, less market power on the side of whales with purchasing power. And that is good news after all.

<< Bitcoin Faucet News October 2021Bitcoin Faucet News January 2022 >>